![]()

ACACIA CAPITAL

With OVER 30 years experience in major markets throughout the United States, Acacia Capital's investment funds have acquired real estate debt and equity interests with an aggregate cost in excess of $6 billion. Throughout its history, Acacia has invested in over 30,000 apartment units and 42,000 single-family home lots.

Our Company

Since forming its first institutional fund in 1992, Acacia Capital has managed a series of commingled investment funds that have acquired both debt and equity positions in real estate with a primary focus on residential property. Our development, finance and real estate operating expertise have allowed us to deliver attractive risk-adjusted returns over an extended period of time. While the majority of capital managed by Acacia is institutional, we also serve a select group of individual and family investors.

Investment Platforms

As real estate and capital market conditions evolve, Acacia continues to develop investment platforms designed to capitalize on market inefficiencies and areas of illiquidity. Our extended presence in the industry allows us to draw on our experience from prior downturns to shape our approach to the current environment. Our modest use of leverage and disciplined underwriting over the years has positioned Acacia to take advantage of current market conditions.

Our Team

Acacia's management team includes executives with hands-on experience in real estate development, construction, operations, acquisition, disposition, and finance. The team's years of working together, broad experience and complementary backgrounds provide a depth of management that allows Acacia to react quickly to favorable investment opportunities while carefully managing risk.

INVESTMENT CRITERIA

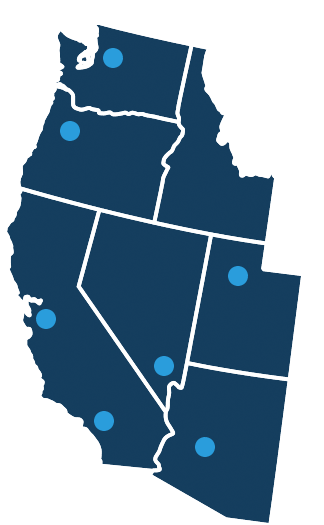

Acacia has extensive experience owning and operating apartments in all major markets in the Western U.S. Acacia is currently seeking opportunities that meet the following criteria:

- Existing Apartment Communities

- 100+ Units

- $20m+ Transaction Size

- Value Add and Core-Plus Opportunity

- Target Markets

- Southern California

- Northern California

- Seattle

- Phoenix

- Portland

- Salt Lake City

- Las Vegas

The material presented on this website has been limited to protect the privacy of our customers and clients. For more information please contact us.